Send us your CV

To quickly send us your details, please fill in the form below.

Mimi has been supporting a professional services tax department to level up their research and development activities.

Mimi has been working for a global professional services firm that provides audit, tax and advisory services. The firm provides a range of innovative tax offerings to assist businesses in maximising their tax benefits related to research and development (R&D) activities.

These offerings help clients identify and claim eligible tax credits, incentives and deductions, ultimately supporting their innovation efforts and reducing their tax liabilities.

The R&D Tax team, recently expanded to a national scale and lacks the necessary specialised experience to effectively assist clients involved in intricate software-related projects seeking R&D tax benefits.

The impending implementation of HMRC's new guidelines introduced in 2023 has heightened the demand for greater technical detail in claims. The team faces the challenge of meeting these elevated requirements within tight deadlines.

To successfully qualify software projects as R&D according to HMRC's specific guidelines, the team requires technical expertise from professionals with software-related backgrounds. Assistance is needed in conducting technical interviews and crafting comprehensive case studies, prompting the creation of a dedicated software specialist team.

Mimi crafted project case studies to bolster client R&D claims. Over time, she has advanced to taking on occasional leadership of technical interviews with clients, with support from colleagues, showcasing her growing expertise.

By strategically allocating the software team's resources, the broader national team has achieved improved progress in handling software-related client claims, leading to higher-quality reports within tighter timeframes.

Mimi's client-facing position has enabled her to accumulate substantial experience in conducting interviews, refining her writing and communication skills.

Skill Development and Reliability

Mimi's involvement has led to the growth of her skills, making her a dependable asset for fellow team members. Her ability to handle diverse clients has strengthened, and she has garnered positive feedback from teammates, indicating her proficiency.

Continuous Improvement

Mimi's commitment to skill enhancement is evident through her consistent efforts. She is actively working on refining her responsibilities, demonstrating her dedication to personal and professional growth.

Impactful Contributions

Mimi's contributions extend beyond routine tasks, including support for significant clients facing HMRC inquiries. Her involvement in the preparation for these engagements underscores her meaningful participation within the team.

“With her application and dedication to quality, Mimi has been a critical member of our software specialist R&D tax consultancy team. Particularly valuable has been her ability to quickly train and learn the core skills of a software specialist in this field, which push beyond the field of data science alone. Her productivity has been consistently high and her proactive attitude to support the wider software team has been invaluable.”

Director of Financial Advisory & Data Analytics

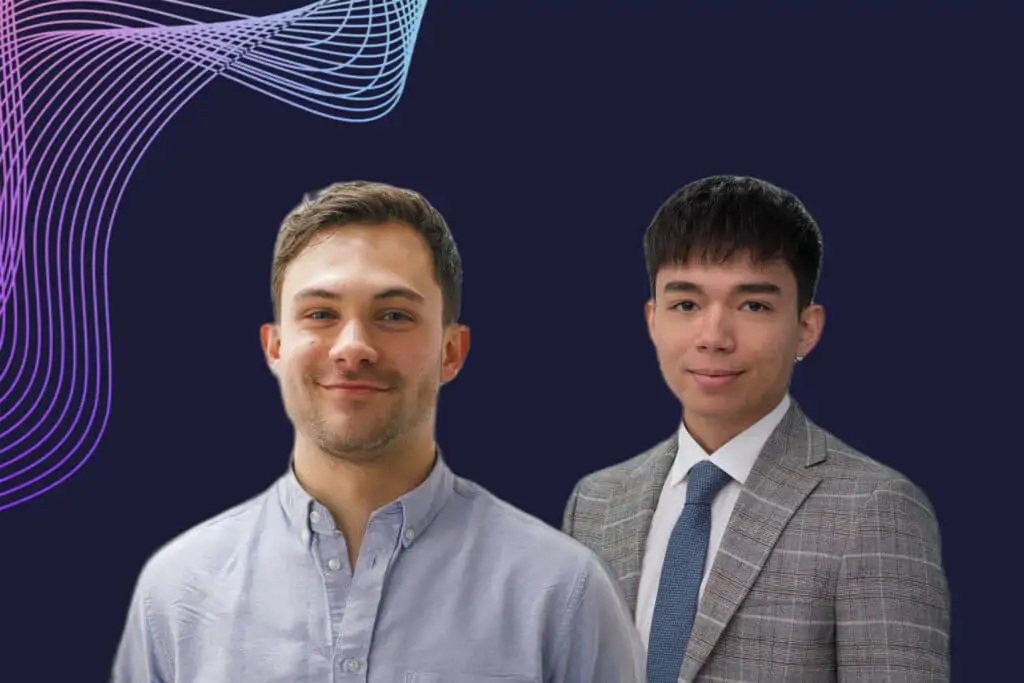

This is Alex & Stephen.

They went from Python developers to data scientists at a major UK telecommunications company.

This is Keasha.

She's been enhancing financial crime analytics capabilities for the world's largest consultancy.

Ready to build great teams? Let's get started.